THE PREMISE

American State Bank isn’t exempt from the challenges that typically plague smaller institutions: Deposit growth, customer engagement, retaining family businesses, “going digital,” staffing demands. Through the years, however, the western Iowa-based community bank has sustained itself largely because of its ties with its surrounding community and relationship-driven banking strategy. But even after decades of doing business with legacy customers and families, not every account can be protected in an era of rate shopping and deposit wars.

The bank, which announced the appointment of a new chief executive officer in May 2023, needed a way to differentiate itself from its peers and provide new, irreplaceable value for its customers. “We wanted to show our customers that we really care about them: To show children that we care about their parents, their grandparents,” says Tamra Van Kalsbeek, digital banking officer at the bank. “To show that for every milestone in a customer’s life, the bank is going to be there every step of the way.” The bank found its answer in a young financial technology called The Postage, which helps consumers securely organize, store, and transfer family finances, estates, and history. A partnership between the two could lead to stickier deposits and position the bank as a resolute institution that keeps family legacies safe and alive through generations.

THE POSTAGE

Emily Cisek, co-founder and CEO of The Postage (est. 2019), understands the complex nature of loss — it’s part of the foundation that built the company. “Those that are left behind are so much more cognizant of their own life, what they leave behind, and post-death financials,” she says. While The Postage can’t take users back in time, it can better prepare them financially and emotionally for future passings, including their own.

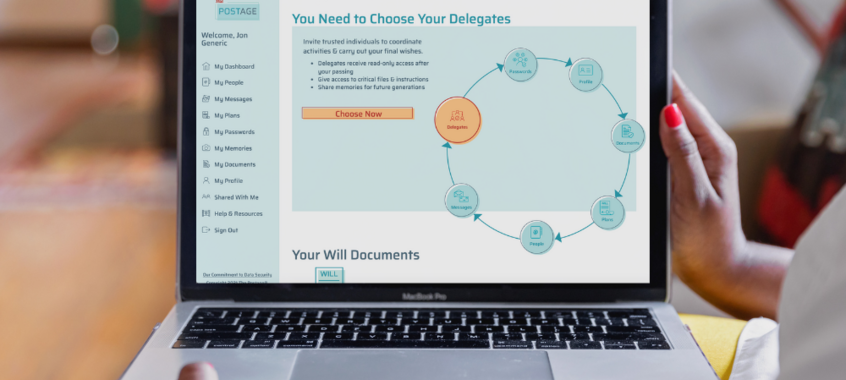

The Postage marries several key components of how people navigate death: Will and estate management, small business succession planning, event and user permissioned document storage, and creating a private family network. Many technologies tackle only one piece of this puzzle, which is useful but not highly interesting, and typically take business away from the bank. The Postage, however, combines each complementary piece within a single platform, which dramatically increases user value and engagement, and keeps the bank at the heart of it all.

THE PURPOSE

Over the next 25 years, 45 million U.S. households will transfer $68 trillion to their children — the biggest generational wealth transfer ever. Without strong ties to originating institutions, children and other inheritors are liable to deposit those assets wherever they please. But while it may be simple to find an institution with a fair interest rate, finding one that also fulfills a customer’s emotional needs may be more laborious. The Postage combines the transfer of wealth and wisdom in one platform, which helps a bank capitalize on those difficult needs. The platform functions as a consumer retail and wealth product, as a human resources benefit, and as a business tool.

While each division targets a different customer profile, the end goal for each stays the same: To help users begin creating the legacy they want to leave before it’s too late. Too many times we find ourselves saying that we didn’t have enough time to prepare, Cisek mentions. “Well, what if we did have the time?”

THE PARTNERSHIP

In the spring of 2022, The Postage participated in Alloy Labs’ Concept Lab, a type of reverse accelerator program that invites a young fintech and a small number of forward-thinking banks to intimately work together for several weeks. The company’s mission aligned strongly with American State Bank’s, and, alongside the bank’s own succession planning, the decision was made to move forward with a proof of concept.

An internal team with representatives from American State Bank, Perspective Insurance, and American Investment & Trust — all subsidiaries of parent company AmBank Company, Inc. — was formed to optimize the pre-pilot conversations and business strategy. This, according to Van Kalsbeek, was key to the success of the project and a gateway to future revenue opportunities. “Getting to work with people from each entity has really made [the bank] look at how strong the potential is to cross sell to our customers. These conversations hadn’t really been happening before.”

A pilot agreement was signed 3 days before the new year. Forty-two days later, the bank had signed a multi-year partnership agreement that spanned across all three subsidiaries. The Postage provided the bank with a two-year marketing plan and messaging templates to help with adoption. The platform was integrated within the bank's web applications for a spring 2023 launch. As of August 2023, approximately 400 customers (4.7% of monthly digitally engaged bank customers) have signed up for The Postage.

THE PROMISE

The Postage is designed to facilitate built- in network effects; users invite immediate family members and close friends to act as executors, beneficiaries, or viewers, who then invite loved ones to their own network. The typical Postage user will invite three to five others to join their Postage account. These users may or may not be bank account holders, which, according to Cisek, is where the bank can spotlight its family-focused brand. Family photos, letters, messages — not balances or debts — are what users primarily interact with, which may prompt them to pursue or continue their own relationship with the bank.

American State Bank has seen a 30% referral rate from these family network effects. Young adults and teens are often invited to join The Postage as well, which allows the bank to build relationships with future heirs are generators long before the passing of wealth occurs.

American State Bank offers its wealth management, estate, and trust services to its Postage users right from within the platform. While The Postage does coach users through how to create, notarize, and upload a will, more complex households may want to confer with a third party. From there, the bank can step in with its internal team. Because American State Bank partnered with The Postage alongside other holding company subsidiaries, the bank has the opportunity to cross-sell across businesses. Currently, Postage users who are customers of Perspective Insurance receive ads on the bank’s products or investment services, and vice versa. The majority of AmBank Company’s clientele only touch one entity, making them prime marketing targets for the other lines of business.

The bank’s “Spirit Club”, a group of 55+ bank customers, have been large adopters and champions of the platform. There were initial concerns about the technology learning curve that might occur, but according to Van Kalsbeek there have been no usage issues. She also notes that more women have signed up than men. A 2020 McKinsey & Company report predicts that by 2030, the majority of the $30 trillion in financial assets that baby boomers currently possess will be transferred down to women (most likely the eldest daughter). The Postage isn’t gender-restricted, but by providing a platform that caters to women and needs that are more prominently felt by them, American State Bank is positioning itself to retain the future wealth they will inherit.

American State Bank will offer The Postage free to its customers till the end of 2023. For every will that is created from within the platform, the bank receives a revenue share. The opportunity to cross-sell is uncapped. There’s no limit as to where The Postage may take American State Bank. It may be two miles from the bank’s headquarters because an aunt received an invitation to watch new family videos. Or it may be in 18 years when a young woman receives a video message from her recently passed grandmother on her first day of college.

"This is 'a rising tide lifts all boats' scenario,” Cisek says, “[the bank] stepped up, provided for its customers, and will now reap the rewards for years to come." No matter what the milestone, American State Bank will be there for its customers every step of the way, keeping legacies alive.

Written by Erika Bailey, Member Experience Manager at Alloy Labs.

Learn More about The Postage here.

If you would like to learn more about getting involved with Alloy Labs Alliance or the Concept Lab, contact Emmett Shipman at emmett@alloylabs.com.

DISCLAIMER